Advisory Note: Reform of OFSI Enforcement Processes and Legislative Impact

1. Executive Summary

HM Treasury’s Office of Financial Sanctions Implementation (OFSI) has published its response to the consultation on enhancing its enforcement processes. The outcome represents a significant shift in the UK’s sanctions enforcement architecture, underpinned by existing powers in the Policing and Crime Act 2017 (PACA) and upcoming legislative amendments.

While OFSI has signalled a tougher stance by seeking to amend primary legislation to double statutory maximum penalties, it has simultaneously introduced a more pragmatic, "tiered" cooperation framework. For the first time, firms can access a cumulative discount of up to 70% off a penalty by combining voluntary disclosure, early reporting, and settlement.

This advisory outline the critical regulatory changes and the specific legislative impacts on your firm's breach reporting procedures.

2. The New Enforcement Framework

A. "Stackable" Discounts: A 70% Incentive

OFSI has revised its discount methodology to be additive rather than sequential. This is a material improvement for firms, as discounts are now calculated against the baseline penalty rather than the reducing balance.

Voluntary Disclosure & Cooperation: Capped at 30% (previously 50% for serious cases).

Early Account Scheme (EAS): A new 20% discount for firms that provide a "comprehensive account" of the breach immediately at the start of an investigation.

Settlement Discount: A 20% discount for agreeing to settle within a 30-day window and waiving appeal rights.

Impact: A firm that self-reports, provides an immediate full account, and settles can achieve a 50-70% reduction in the final fine. Conversely, firms that fail to self-report but later settle lose the 30% tranche, significantly raising the cost of non-compliance.

B. The "Early Account" Scheme (EAS)

Modelled on the Bank of England's approach, the EAS is designed to expedite investigations.

Requirement: Firms must provide a "full and complete account" along with relevant evidence upfront.

Risk: Entering the EAS requires a high degree of confidence in your internal investigation's accuracy. An incorrect early admission could be problematic, although the discount is applied regardless of whether the firm eventually settles or contests.

C. Fixed Penalties for Administrative Breaches

For less severe infractions, specifically information, reporting, and licensing offences, OFSI is moving away from the heavy-handed civil monetary penalty process.

New Regime: Fixed penalties of £5,000 or £10,000 will be introduced via guidance, utilising OFSI's existing powers without requiring immediate legislative amendment.

Process: These will have a shorter representation window of 15 business days (down from 30).

3. Legislative Changes: Policing and Crime Act 2017 (PACA)

The most significant structural change involves proposed amendments to the statutory framework governing civil penalties.

Doubling of Statutory Maximums (Section 146 PACA)

Currently, OFSI’s powers to impose monetary penalties are derived from Section 146 of the Policing and Crime Act 2017.

Current Law: Under s.146(3) and (4), the maximum penalty is the greater of £1 million or 50% of the estimated value of the funds or resources involved in the breach.

Proposed Amendment: OFSI intends to seek legislative change to increase this cap to the greater of £2 million or 100% of the breach value.

Status: This change is not immediate. It requires the passing of new legislation, subject to Parliamentary time. However, it signals a clear intent to align UK penalties closer to the severe punitive measures seen in the US enforcement landscape.

Secondary Legislation

OFSI also noted that for certain specific offences, its penalty powers are set out in secondary legislation. While the primary focus of the consultation was on the PACA powers, firms should remain aware that sector-specific regulations may carry their own distinct enforcement nuances.

4. Strategic Implications & Recommendations

1. Re-calibrate Internal Investigation Timelines The introduction of the Early Account Scheme (EAS) creates a "race to report." To secure the additional 20% discount, your firm must be able to investigate and present a comprehensive factual account faster than before.

Action: Review your internal investigation protocols. Can you mobilise legal and forensic resources quickly enough to utilise the EAS?

2. Assess the "Settlement" Trade-off the Settlement Scheme requires waiving the right to a Ministerial Review and to appeal OFSI's decision judicially.

Advisory: In cases where the facts are clear, the certainty of a 20% discount (on top of other reductions) likely outweighs the cost and reputational damage of a prolonged legal battle. However, for novel points of law, the loss of appeal rights is a significant concession.

3. Prepare for Higher Stakes Although the amendment to s.146 of PACA requires legislation, OFSI’s intent is clear. The financial exposure for major breaches is effectively doubling. This should be reflected in your firm’s risk appetite statements and capital provisioning for operational risk.

Conclusion

This consultation response signals a maturation in OFSI’s enforcement strategy, shifting towards a model that heavily incentivises speed and transparency. The strategic imperative for firms is now clear: those capable of rapidly investigating and self-reporting can access substantial penalty mitigation. Conversely, firms that fail to cooperate face a hardening enforcement environment and the prospect of doubled statutory penalties under future legislation.

We strongly advise updating your firm’s breach response protocols immediately. Your internal processes must now be agile enough to meet the tight timelines of the new Early Account and Settlement schemes, ensuring you do not leave these significant discounts on the table.

"For strategic thinking and discussion purposes only, we have drafted the following checklist to assist your Legal & Compliance teams in evaluating whether to utilise the new 'Early Account Scheme'." Please see below.

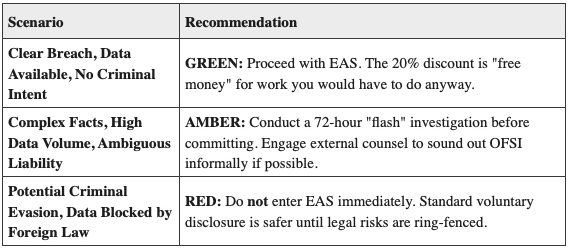

ADVISORY TOOL: DECISION PROTOCOL FOR THE EARLY ACCOUNT SCHEME (EAS)

IMPORTANT DISCLAIMER: This document is intended for general information and strategic planning purposes only. It does not constitute legal advice or a professional legal opinion on any specific facts or circumstances. Sanctions enforcement involves complex questions of law, including potential criminal liability. In the event of a suspected sanctions breach, you should immediately seek independent advice from qualified external legal counsel before communicating with regulators.

This checklist is designed to help your internal triage team decide, often within 24 - 48 hours of discovering a potential breach, whether to commit to the EAS. Entering the scheme offers a 20% penalty reduction but requires an upfront commitment to deliver a "full and complete" factual account, usually within a timeframe agreed with OFSI.

Phase 1: Certainty of Facts (The "Admission" Test)

Entering the EAS effectively signals that the firm accepts the factual basis of the breach. Do not enter if there is significant ambiguity about whether a breach actually occurred.

Is the breach factually undeniable?

Yes/No: Is the transaction/activity clearly documented in our systems?

Risk: If the facts are murky or rely on complex interpretations of "control" or "ownership," entering EAS may be premature.

Is the breach strictly "historical"?

Yes/No: Has the conduct ceased?

Note: OFSI is unlikely to accept an EAS application if the breach is ongoing and uncontained.

Do we have a clear "theory of the case"?

Yes/No: Do we understand why it happened (e.g., screening failure, human error, circumvention)?

Risk: You cannot provide a "full account" if you don't yet understand the root cause.

Phase 2: Operational Capability (The "Speed" Test)

The EAS is a commitment to speed. Failure to meet the agreed reporting deadline can result in the discount being revoked and reputational damage with the regulator.

[ ] Is the data readily accessible?

Yes/No: Are the relevant emails, SWIFT messages, and KYC documents in a jurisdiction/system we can access immediately?

Blocker: Data privacy laws (e.g., GDPR, blocking statutes) in other jurisdictions that might delay evidence gathering.

[ ] Can we mobilise a forensic review team immediately?

Yes/No: Do we have internal audit or external counsel capacity to start today?

[ ] Is the volume of evidence manageable?

Yes/No: Is this a single transaction or 10,000?

Advisory: If the scope is massive, can we realistically promise a full report within a standard 3 - 6 month window?

Phase 3: Legal & Strategic Risk

The trade-off for the discount is the waiver of certain procedural standard-steps.

Are there parallel criminal implications?

Check: Does this breach involve wilful evasion that could trigger a criminal referral to the National Crime Agency (NCA)?

Advisory: If criminal prosecution is a real risk, providing an "Early Account" to a civil regulator requires extreme caution and seek immediate external counsel advice regarding privilege and self-incrimination.

Have we assessed the impact on Legal Professional Privilege (LPP)?

Check: Can we provide the "factual account" OFSI demands without waiving privilege over legal advice received during the incident?

Are other regulators involved (e.g., OFAC, FCA)?

Check: Will an early admission to OFSI prejudice our position with US authorities?

Author - Manmeet Lotay, Global Sanctions Advisor, Ferrer Consultancy Services

Ferrer Consultancy Services empowers clients to stay ahead of sanctions risk through proactive, data-driven controls that build resilience and agility in an evolving global landscape. By enhancing sanctions frameworks and implementing proactive risk mitigation strategies, Ferrer Consultancy Services enables organisations to anticipate and manage sanctions exposure not just react to it, ensuring confidence in a constantly shifting regulatory ecosystem.

If you're ready to turn compliance into a competitive advantage, contact us today to learn how we can help your organisation proactively manage and mitigate sanctions risks.

Office: (+44) 0208 797 0396

Mobile: (+44) 0759 529 2295

Email: info@ferrer-consultancy.com